IQ Boost™: Canadian AI Built for Financial Advisors

Advisors know that managing notes, records, and compliance reviews can consume hours each week. It’s necessary, but it often takes time away from client conversations—and missed details can mean missed opportunities or even compliance risk.

Assistants and administrators feel that weight too, spending hours ensuring records are audit ready. It’s the work that keeps practices running, but it doesn’t grow client trust or build the book of business.

Introducing IQ Boost

That hidden weight of prep work is exactly what IQ Boost was built to lift.

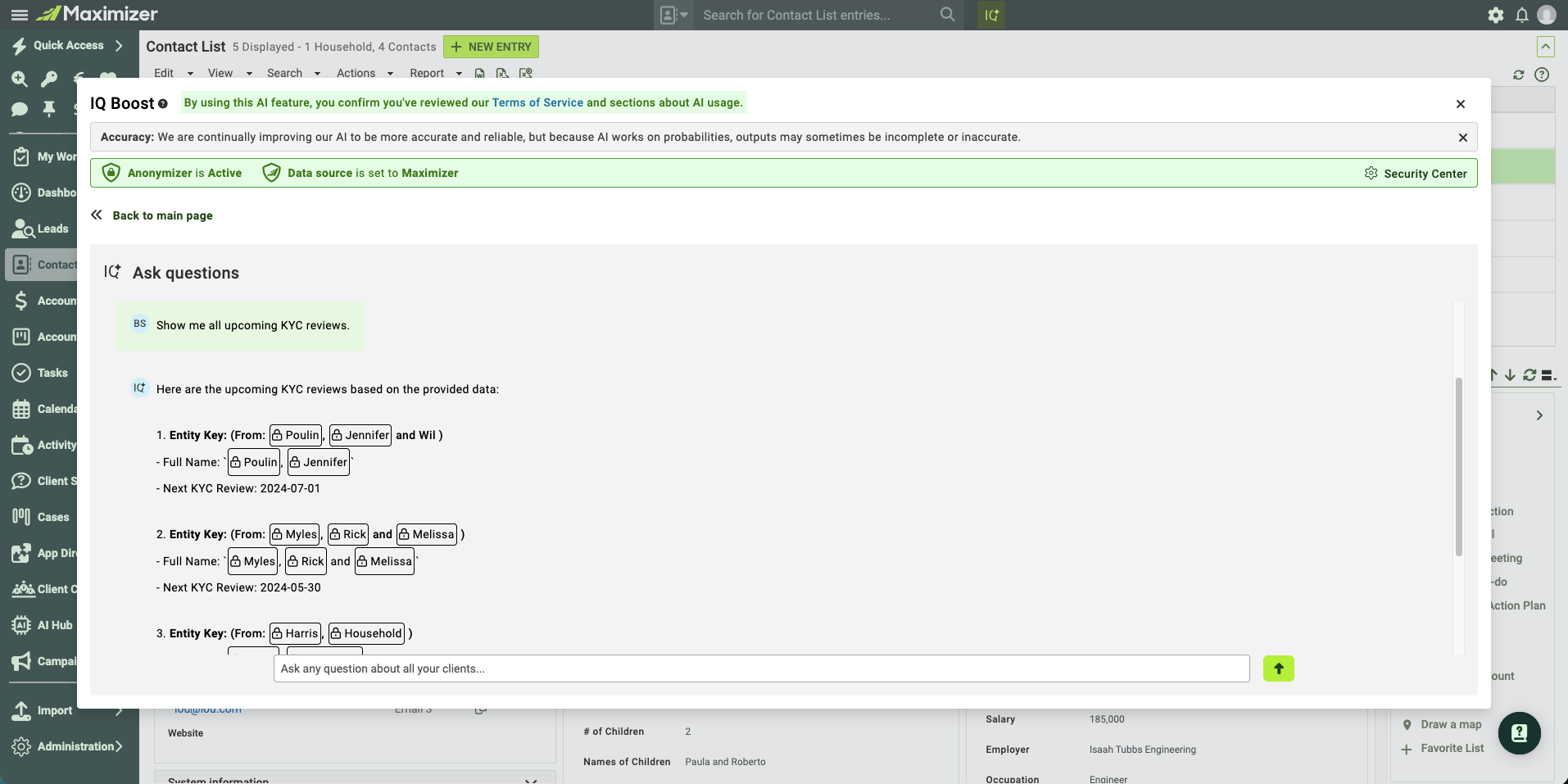

IQ Boost is designed to change the way advisors prepare by turning existing CRM data into clear, actionable insights in seconds. Embedded directly into Maximizer CRM, it’s Canadian-built, secure by design, and tailored for the way advisors actually work.

Instead of searching through files, you simply prompt IQ Boost and see what matters most—summarized, clear, and ready to act on.

With IQ Boost, you can:

- Save hours of prep with instant summaries of conversations, household records, and client histories.

- Stay audit-ready with KYC reviews and other compliance tasks surfaced the moment you check a client record.

- Act on life events such as RESP planning when a child is added to a household or RRSP-to-RRIF conversions due at year-end.

- Expand your book by managing more clients without sacrificing service quality or adding staff.

It’s AI that works inside your CRM—not another system to learn or manage.

Why advisors need IQ Boost today

Advisors are expected to manage larger books, meet stricter compliance demands, and still deliver the personalized service clients expect. Firms are under pressure too, doing more with fewer resources.

IQ Boost bridges that gap with practical AI. It gives advisors clarity in prep, confidence in compliance, and capacity to grow.

For firms, that means compliance confidence and scalable capacity.

For advisors, it means walking into every meeting prepared, relevant, and trusted.

For Maximizer, it marks the next step in our evolution—investing in secure, advisor-first AI that strengthens the way Canadian wealth professionals work.

What the industry is saying

Industry professionals say AI is no longer optional in wealth management.

“AI in CRM is no longer a nice-to-have. It’s becoming table stakes for wealth management. Advisors are expected to handle larger books with fewer resources. AI helps close that gap. It’s not about replacing advisors, it’s about giving them time back to focus on clients.”

— Victor Toth, Head of Data & Analytics, Canaccord Genuity

“Across financial services, AI is proving to be one of the most effective ways to boost productivity. From compliance workflows to client engagement, it’s helping firms work smarter and respond faster to client needs.”

— Patrick Burkart, Benefits Consultant, HUB International

The takeaway for advisors

Canada’s $1-trillion wealth transfer is already underway. Advisors who thrive in this environment will be the ones who turn complexity into clarity and act on client needs with speed and confidence.

IQ Boost empowers you to do exactly that: spend less time chasing records and more time building trust, protecting assets, and growing your book for the future.